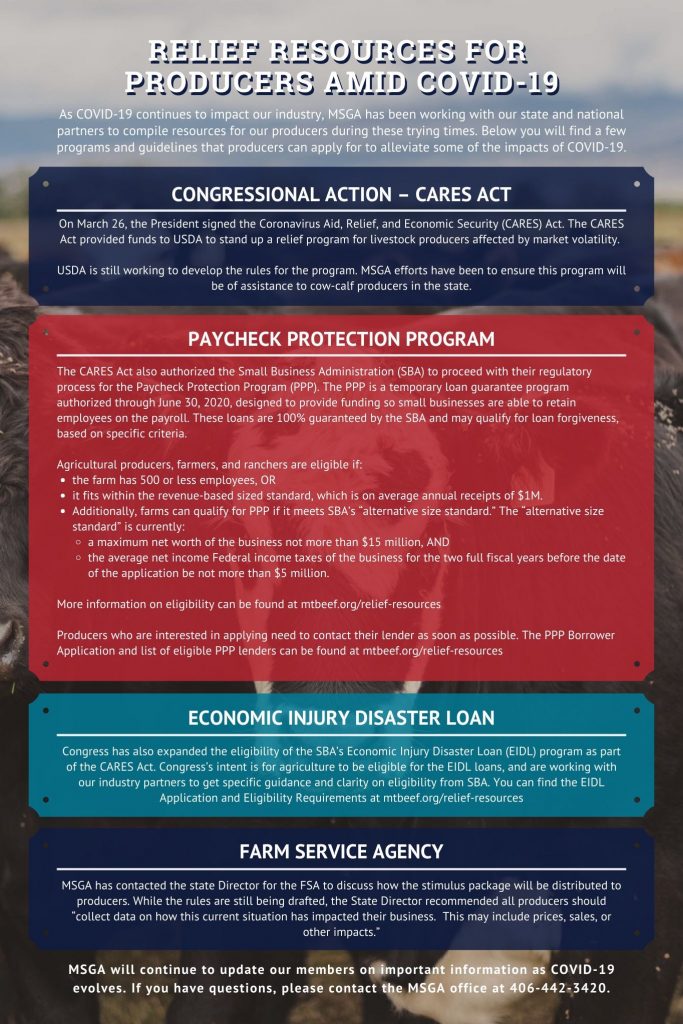

As COVID-19 continues to impact our industry, MSGA has been working with our state and national partners to compile resources for our producers during these trying times. Below you will find a few programs and guidelines that producers can apply for to alleviate some of the impacts of COVID-19.

Congressional Action – CARES Act

On March 26, the President signed the Coronavirus Aid, Relief, and Economic Security (CARES) Act. The CARES Act provided funds to USDA to stand up a relief program for livestock producers affected by market volatility. USDA is still working to develop the rules for the program. MSGA efforts have been to ensure this program will be of assistance to cow-calf producers in the state.

Paycheck Protection Program

The CARES Act also authorized the Small Business Administration (SBA) to proceed with their regulatory process for the Paycheck Protection Program (PPP). The PPP is a temporary loan guarantee program authorized through June 30, 2020, designed to provide funding so small businesses are able to retain employees on the payroll. These loans are 100% guaranteed by the SBA and may qualify for loan forgiveness, based on specific criteria.

Agricultural producers, farmers, and ranchers are eligible if:

- the farm has 500 or less employees, OR

- it fits within the revenue-based sized standard, which is on average annual receipts of $1M.

- Additionally, farms can qualify for PPP if it meets SBA’s “alternative size standard.” The “alternative size standard” is currently:

- a maximum net worth of the business not more than $15 million, AND

- the average net income Federal income taxes of the business for the two full fiscal years before the date of the application be not more than $5 million.

More information on eligibility can be found at:

- SBA Small Business Compliance Guidelines to determine eligibility for SBA programs, or

- https://www.usda.gov/coronavirus

Producers who are interested in applying need to contact their lender as soon as possible.

Economic Injury Disaster Loan

Congress has also expanded the eligibility of the SBA’s Economic Injury Disaster Loan (EIDL) program as part of the CARES Act. Congress’s intent is for agriculture to be eligible for the EIDL loans, and are working with our industry partners to get specific guidance and clarity on eligibility from SBA. You can find the EIDL Application and Eligibility Requirements here.

Farm Service Agency

MSGA has contacted the state Director for the FSA to discuss how the stimulus package will be distributed to producers. While the rules are still being drafted, the State Director recommended all producers should “collect data on how this current situation has impacted their business. This may include prices, sales, or other impacts.”

MSGA will continue to update our members on important information as COVID-19 evolves. If you have questions, please contact the MSGA office at 406-442-3420.

PRESS CONTACT:

Keni Reese

Director of Marketing & Communications, MSGA

406-442-3420

[email protected]

To view more MSGA news, visit https://mtbeef.org/news/